The

summer wind came blowin' in from across the sea

It

lingered there, to touch your hair and walk with me

All

summer long we sang a song and then we strolled that golden sand

Two

sweethearts and the summer wind

Like

painted kites, those days and nights they went flyin' by

The

world was new beneath a blue umbrella sky

Then

softer than a piper man, one day it called to you

I lost

you, I lost you to the summer wind

The

autumn wind, and the winter winds they have come and gone

And

still the days, those lonely days, they go on and on

And

guess who sighs his lullabies through nights that never end

My

fickle friend, the summer wind

The

summer wind

Warm

summer wind

The

summer wind

SONGWRITERS: HANS BRADTKE, HENRY MAYER, JOHNNY MERCER

SINGER: Frank Sinatra

After a ten day break Rink Rats is back for another eight

weeks until our August two week break. We begin the summer after a wonderful

visit to family and friends.

It should be a very interesting summer: 28 days to

Cleveland, 35 days to Philly, and 141 days to Election Day.

Two weeks ago we lost Muhammad Ali, this past week we lost a

hockey legend Gordie Howe. My youth was spent watching and following Gordie

Howe Number 9, a true sportsman.

SUMMER

READING – Three

business books to read this summer:

Grit by Angela Duckworth

This book is about the tenacity that underscores

most successful ventures and individuals. Grit has a heartwarming message for

entrepreneurs and seasoned business people alike: Effort trumps talent. In

other words, the more tenacious and hardworking you are, the better your

chances of success. This is not a new discovery or revelation. What makes

Duckworth’s message compelling is her use of examples and research from an

assortment of fields and sciences, ranging from the humanities to business. To

be sure, Duckworth, who previously won a MacArthur “Genius” research grant,

does not discount the role of talent and luck in determining success for a

venture or individual. However, she provides enough reasons (and examples) to

encourage and spur hard workers into action. According to the Scientific

American, Grit is “a lucid, informative and entertaining review of the latest

research on grit and how it can be developed.”

Breaking Rockefeller: Peter B. Doran

In times of oil prices that have roiled the energy

markets, what could be a better read than a book about the breakup of Standard

Oil? At first glance, the situation today and the one at the turn of last

century may seem different. Then, Standard Oil held an 80 percent monopoly of

the world’s oil supply. Two upstarts - Royal Dutch company and Shell - joined

forces along with the U.S. Department of Justice to bring down the behemoth.

However, the situation today is not too dissimilar

in that the hegemony of traditional oil suppliers, such as large multinationals

and cartels (such as OPEC), has been challenged by upstarts in the shale

industry. Supply has outstripped demand, as it did during the turn of last

century.

While not as comprehensive as Daniel Yergin’s The

Prize, Breaking Rockefeller is a satisfying read nonetheless because it is a

crash course on the politics and economics of oil markets without the attendant

jargon. Instead, Doran, who is the vice president for research at the Center

for European Policy Analysis, focuses on the people who drove the story

forward. These range from Marcus Samuel, a businessman who founded Shell and

craved a royal title, to Henri Deterding, who was responsible for expanding

Royal Dutch in the Far East, to Rockefeller, who, Doran says, tried underhanded

and unscrupulous tactics to deter competitors. In his review of the book, Roger

Lowenstein (author of Warren Buffett’s biography) writes that the book “emulates

the best oil literature, in which geology and geopolitics go hand in hand.”

Money Changes Everything: William Goetzmann

The central premise of this book is that money made

civilization happen. In other words, money came first and civilization (and organization

of society) followed. Money, according to Goetzmann, is a “movement”

technology, just like automobiles. It has and will evolve over time to change

with circumstances. Goetzmann, who is a professor at the Yale School of

Management, perambulates through the history and evolution of money to make his

point. In the words of the FT reviewer, “he (Goetzmann clearly sees the

problems as bumps in the road towards a richer and more advanced civilization.

Bubbles, crashes, and bailouts are sidebars in this history: Money Changes

Everything is centrally a celebration of progress.

SUMMER

BINGE WATCHING - Binge-watching, also called binge-viewing or

marathon-viewing, is the practice of watching television for a long time span,

usually of a single television show. In a survey conducted by Netflix in

February 2014, 73% of people define binge-watching as "watching between

2-6 episodes of the same TV show in one sitting." Binge-watching as an

observed cultural phenomenon has become popular with the rise of online media

services such as Netflix, Hulu, and Amazon Video with which the viewer can

watch television shows and movies on-demand.

Binge Recommendations: House

of Cards and Game of Thrones are

the same basic show. When you boil it down, each is a collection of

morally-ambiguous characters playing a political game of cards.

Other popular binge viewing shows: Orange is the New Black, Billions, The Good Wife and the ESPN

documentary O.J. Simpson, Made in Amercia.

But be careful - A Cambridge University statistics professor

says binge watching shows is dampening our sex lives. And it's all Netflix's

fault. Hulu, and Amazon Prime's. And HBO's.

He explained that in 1990 couples reported having sex five

times a month. Now it's down to three times.

By 2030, it could be down to no getting down to it at all.

The point is...this massive connectivity, the constant

checking of our phones compared to just a few years ago when TV closed down at

10:30 p.m. or whatever and there was nothing else to do," he said. Sex was

great when there wasn't great TV. Now, not so much.

COLLEGE

CHRONICLES - HOW

MUCH FRAUD IS THERE IN HIGHER ED?

The Obama administration is

offering its best guess to that sweeping question. As part of the

administration's proposal, unveiled last week, to write new rules governing

debt relief for student loan borrowers who were deceived or defrauded by their

college, the Education Department had to outline its complicated analysis for

gauging the plan's potential hit to taxpayers.

CALIFORNIA

DROUGHT BUMMER - Sierra water runoff coming up short: The

Department of Water Resources now projects that the mountains will produce

about three quarters of normal runoff during the months of heaviest snowmelt,

shorting the rivers and reservoirs that typically provide a third of

California's water - and cementing a fifth year of historic drought for the

Golden State. ... The projections arrive alongside forecasts for potentially dry

La Niña weather next winter.

BAD

DAYS FOR CONSERVATIVES CONTINUE - End of conservative Supreme

Court: Clarence Thomas may be next to leave: Thomas, a reliable conservative

vote on the Supreme Court, is mulling retirement after the presidential

election, according to court watchers. Thomas ... has been considering

retirement for a while and never planned to stay until he died ... He likes to

spend summers in his RV with his wife. ... Should Thomas leave,

[conservatives'] slight majority would continue if Donald Trump becomes

president. ... Clinton ... would get the chance to flip two Republican seats,

giving the liberals a 6-3 majority.

HOME IS

WHERE THE MONEY IS - The

U.S. housing market has almost completed the long road back from the mire. Home

prices are at near-record highs across the U.S., a sign that the lopsided

housing-market recovery of the past five years is gaining some strength. The

S&P/Case-Shiller national home-price index has clawed its way back to

within 4% of its 2006 peak and U.S. new-home sales in April posted their

strongest month in more than eight years. That bodes well for sellers heading

into the peak home-selling season in May and June but could pose challenges for

buyers, especially first-timers, as overall sales volume and new construction

remain well below their pre-crisis peaks. Meanwhile, new tariffs on imports are

boosting steel prices in the U.S., offering a lifeline to beleaguered American

steelmakers but raising costs for manufacturers of goods ranging from oil pipes

to factory equipment to cars.

SOROS

IS BACK - After a long hiatus, George Soros has returned to

trading, lured by opportunities to profit from what he sees as coming economic

troubles. Worried about the outlook for the global economy and concerned that

large market shifts may be at hand, the billionaire hedge-fund founder and

philanthropist recently directed a series of big, bearish investments,

according to people close to the matter. Soros Fund Management LLC, which

manages $30 billion for Mr. Soros and his family, sold stocks and bought gold

and shares of gold miners, anticipating weakness in various markets.

Investors often view gold as a haven during times of

turmoil. The moves are a significant shift for Mr. Soros, who earned fame with

a bet against the British pound in 1992, a trade that led to $1 billon of

profits. In recent years, the 85-year-old billionaire has focused on public

policy and philanthropy. He is also a large contributor to the super PAC

backing ... Hillary Clinton and has donated to other groups supporting

Democrats.

BIRTHDAYS

THIS WEEK – Birthday wishes and thoughts this week to: Marv Albert

(75) Brooklyn, NY; Jim Belushi (62) Chicago, IL; Jeff Dillon …famous St.

Lawrence graduate; Dan Fouts (65) La

Jolla, CA; Michael J. Fox (55) Woodland

Hills, CA; Bill Maher (60) Brentwood,

CA; Joe Montana (60) Napa, CA; Aaron

Sorkin (55) Santa Barbara, CA; Bob

Vila (70) Boca Raton, FL.

CALIFORNIA

GOLD

- Surging California economy vaulted to world's 6th largest in 2015. $2.46

trillion last year. 5.7 percent growth. "In broad ... categories,

California's finance and insurance sector was the largest in 2015 at $535

billion, with government at $300 billion and manufacturing at $278 billion.

Agriculture, once an economic mainstay, was just $39 billion.

But oh yeah, one thing ... that doesn't take into account

our insane cost of living: Once that's factored in, the IMF data finds

California drops from sixth to eleventh in the global size of its gross

domestic product. That still eclipses other U.S. states, but is some important

context for politicians who might be freshening up their talking points.

HOLLYWOODLAND – One

of our favorites, “Curb Your Enthusiasm” Returning to HBO: Curb Your Enthusiasm

last aired an original episode in September 2011, and the nearly five-year gap

since has seen neither HBO nor Larry David ready to publicly dismiss the idea

of revisiting the show. ... On his decision to revisit his alter ego, David had

this to say: 'In the immortal words of Julius Caesar, "I left, I did

nothing, I returned.

THE

SWAMI’S WEEK TOP PICKS –

Major League Baseball Game of the Week:

Saturday June 25, 9:20 pm ET, TSN; Boston Red Sox (39-31) vs. Texas Rangers

(46-25), Texas is running away with the American League West, Red Sox battling Baltimore

in the East. We like “Baston” tonight 6 –

4.

Season

to date (49 -34)

MARKET

WEEK

- Nevada has led the nation in unemployment for 27 months, taking the mantle

from Michigan, which had the nation’s worst unemployment rate for 47 months

from April 2006 to February 2010.

Here's a breakdown of the states with the highest jobless

rate in the country since 1976: http://on.wsj.com/MmE0t9

The prospect of Britons voting to leave the EU this week

fueled global market upheaval on last week, with investors rushing for safety

and sending the UK currency and stocks to their lowest levels in months. ...

The accelerating shift, which came after a trio of opinion polls showed Leave

leading by significant margins, was most marked in government bonds, where a

series of records were smashed as cash flowed into the relative security of

sovereign debt.

German 10-year Bunds traded with interest rates below zero

for the first time after Japan's benchmark fell to a new low of minus 0.185 per

cent. The UK's 10-year gilt yield recorded a new low, and the 30-year bond

dropped below 2 per cent for the first time.

In Switzerland almost the entire market for Swiss government

debt had fallen below zero, with 30-year debt offering an annual yield just

below zero. The US 10-year Treasury note yield at 1.6 per cent was just above

its lowest close since 2012.

DRIVING

THE WEEK - U.K. votes Thursday on whether to say in the EU. A win

for the Leave side could send markets reeling and throw an unexpected wild card

into to the presidential race ... Fed Chair Janet Yellen testifies before

Senate Banking at 10:00 a.m. Tuesday and before House Financial Services at

10:00 a.m. Wednesday ... Senate Banking has its bank capital hearing Thursday

at 10:00 a.m. ... House Financial Services has a terrorism financing hearing at

10:00 a.m. Thursday

Next

week: Back to the future and what is on the iPad.

Until Next Time, Adios.

Claremont, CA

June 21, 2016

#VI-46-308

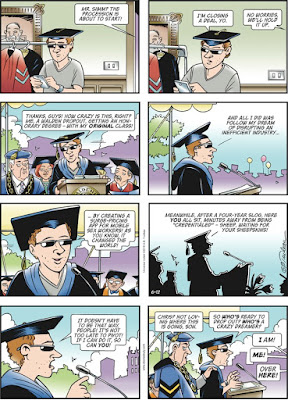

CARTOON

OF THE WEEK –Doonesbury

by Garry Trudeau

No comments:

Post a Comment